When Appraising a Business Equity Interest the Appraiser Must Identify

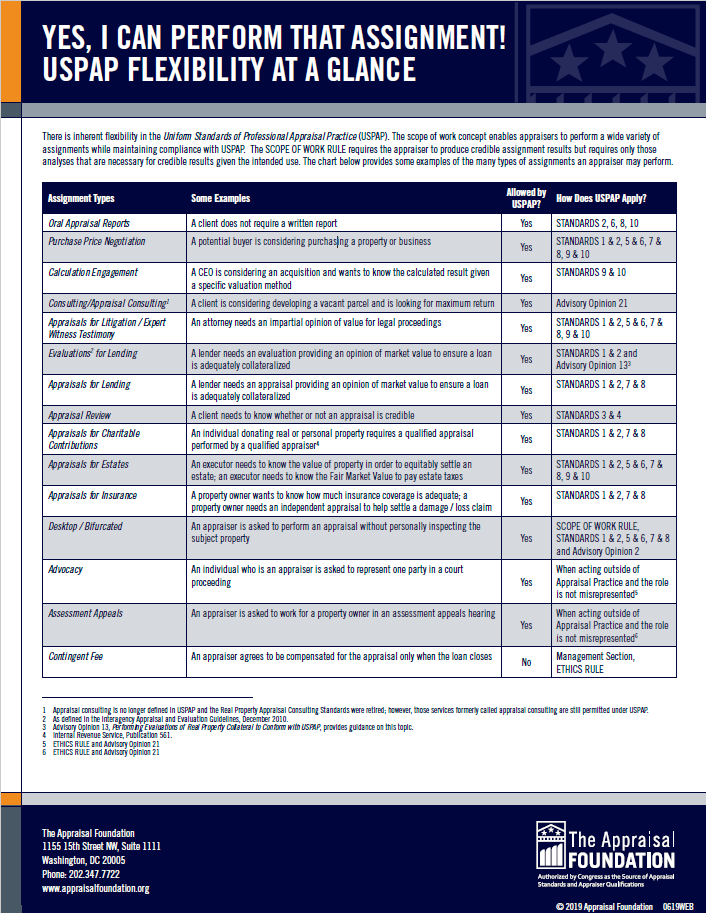

In an appraisal assignment if the appraiser simply changes the name of the client the appraiser is not following the requirements under Standard 1 of USPAP to identify the client intended users and intended use with regard to this second client in the proper sequence. The Appraisal Standards Board ASB of The Appraisal Foundation develops interprets and amends the Uniform Standards of Professional Appraisal Practice USPAP on behalf of appraisers and users of appraisal services.

Virtual Briefing Appraisal Standards And Appraiser Qualifications Criteria Nfha

The exchange where the stock trades.

. Types of Assets Common types of assets include current non-current. If a borrower cant make his monthly payment over the long-term the lender wants to know it can recoup the cost of the loan. In reporting the results of an appraisal of an interest in a business enterprise or intangible asset an appraiser must communicate each analysis opinion and conclusion in a manner that is not misleading.

31 The review appraiser must conduct an appraisal review in the context of market conditions as of the. The steps in the appraisal process are. Documentation sufficient to identify the extent and character of the proposed improvements.

In developing an appraisal of an interest in a business enterprise or intangible asset an appraiser must. All relevant buy-sell and option agreements the exchange on which the stock is traded. An accurate appraisal protects youthe borrowertoo.

An appraiser must not allow the intended use of an. Gather and record and verify the data for each approach. The 2008-2009 Edition of USPAP 2008-2009 USPAP is effective January 1 2008 through December 31 2009.

Please contact your educational provider for a schedule of course offerings. According to USPAP Standards Rule 9-3 in developing an appraisal of an equity interest in a business enterprise with the ability to cause liquidation an appraiser must investigate the possibility that the business enterprise may have a higher value by liquidation of all or part of the enterprise than by continued operation as is. Edits were made to the personal property appraisal requirements to identify and report the highest and best use.

Howell and Korver-Glenn identify that all appraisers complied with a uniform definition of market value that specified that appraisal values should be the most probable price in an open and fair sale A. List the data needed and its sourcesâ. The real estate tax on a property with a PACE loan for energy improvements will exceed the typical real estate taxes for a similar property.

32 In performing an appraisal review the review appraiser must. Each appraisal assignment under this section must. For each appraisal or consulting assignment the appraiser must identify the problem determine the information necessary for credible results and disclose the documents in report.

The source of the funds if the intended use is for a purchase. Appraisers must identify PACE loans on the subject and or comparables sales used in valuations. Addresses the content and level of information required in communicating the results of an appraisal of an interest in a business enterprise or intangible asset and states.

Ethics competency record keeping. An appraiser must identify_____ when appraising a business equity interest. Note 111 Comment.

Rules Set up by USPAP. Interest in a business enterprise or intangible asset an appraiser must identify the problem to be solved determine the scope of work necessary to solve the problem and correctly complete the research and analyses. In Junia Howell and Elizabeth Korver-Glenns original research article Neighborhoods Race and the Twenty-first-century Houring Appraisal Industry Dr.

Business Valuation Personal Property Mass Appraisal and Real Property. Identify the client and owner of the property may be the same. Identify the intended use of the appraisal.

The Certified General Real Property Appraiser must have completed no less than four going concern appraisals of equivalent special use property as the property being appraised within the last 36 months as identified in the qualifications portion of the Appraisal Report. These courses are available for several appraisal disciplines. Understand the levels of value.

Identify all intended users of the appraisal and their needs. A identify the client and other intended users. Identify the effective date of the value opinions.

All owners of the subject interest. An inflated appraisal value can leave. Yet business appraisers are engaged to develop a reasonable range of value for client companies.

Analyze and interpret the data. Reconcile data for the final estimate. Business assets are commonly appraised especially in instances when the business must cease operations.

The Top 3 Things a Business Owner Should Know When Selecting a Business Appraiser. There is no such thing as the value of a closely held business. Identify ownership interest to be valued usually 100 and any encumbrances or restrictions thereon.

Note 110 b identify the intended use of the appraiser s opinions and conclu-sions. When appraising a business equity. Standards Rules 7-3a 8-2aix 6-3b and 6-8n.

Signing appraisers must not rely on the work of others if that appraiser has a reason to doubt that the work is credible. In order for the appraiser to identify the scope of work appropriately the appraisal must identify the Lender as the client andor an intended user of the appraisal as those terms are defined in USPAP except that federally-regulated Lenders may follow their primary regulators. The lender requires an appraisal for home equity loansno matter the typeto protect itself from the risk of default.

In doing so the appraiser is looking to determine the assets book value This is calculated by deducting the business liabilities from its assets. Gather record and verify the specific data such as site development. Gather record and verify the data.

Effective date of the work under review. The Appraisal Foundation has developed a series of courses related to the Uniform Standards of Professional Appraisal Practice USPAP. That is an implicit assumption in the field of business appraisal.

In such cases the appraisal must clearly identify any prospective value describe the prospective event and provide the projected date on which the event is expected to occur.

Uniform Standards Of Professional Appraisal Practice Uspap

Pdf Practical Issues In The Valuation Of Real Properties With Special Reference To Income Approach And Financial Reporting Purpose

Uniform Standards Of Professional Appraisal Practice Uspap

Uniform Standards Of Professional Appraisal Practice Uspap

Sweet Treat For Buyers Super Low Mortgage Rates Sticking Around Lowest Mortgage Rates Mortgage Rates Mortgage Interest Rates

Pdf Residential Appraisal And The Lending Process A Survey Of Issues

Pdf Appraiser Behaviour And Appraisal Smoothing Some Qualitative And Quantitative Evidence

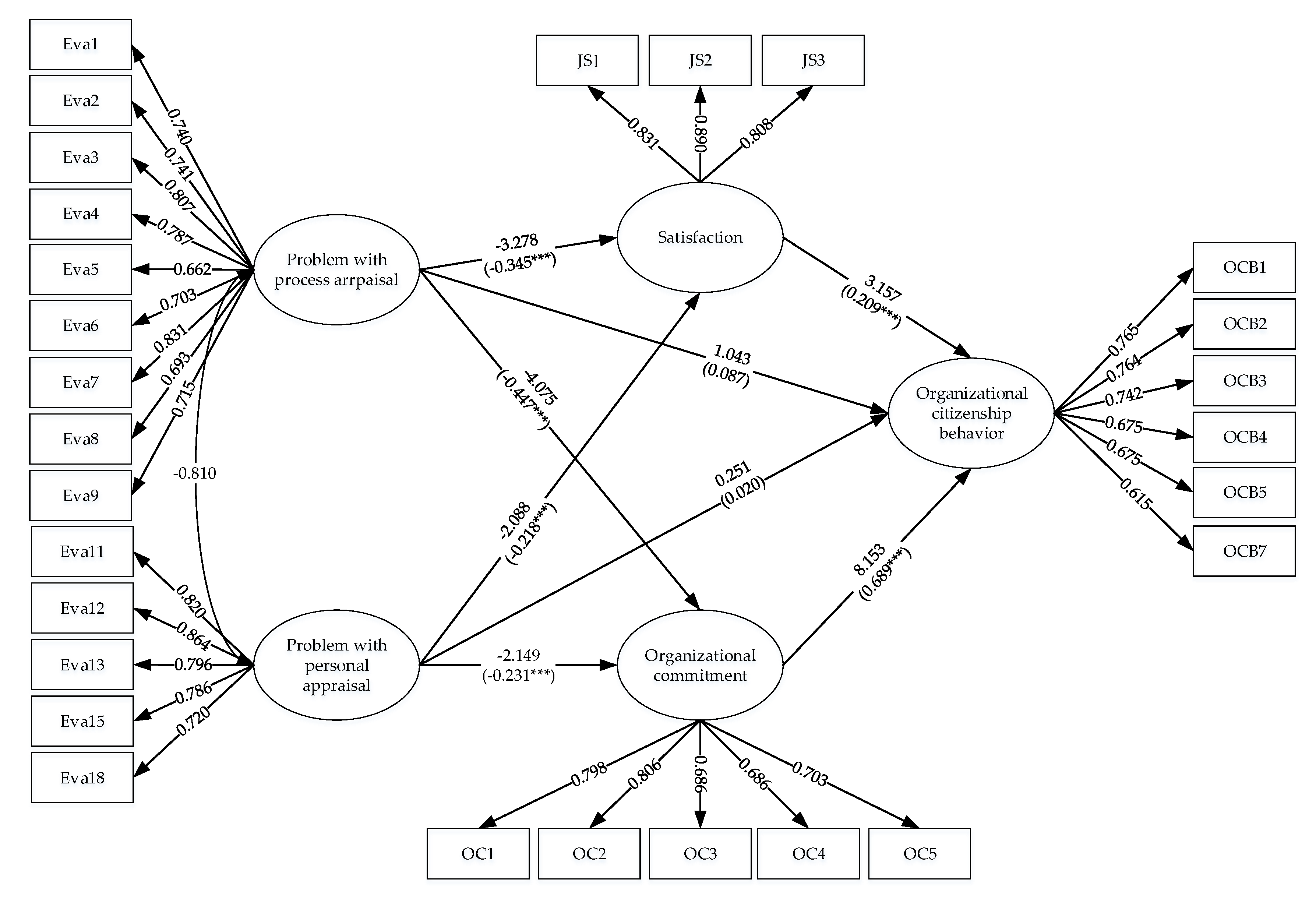

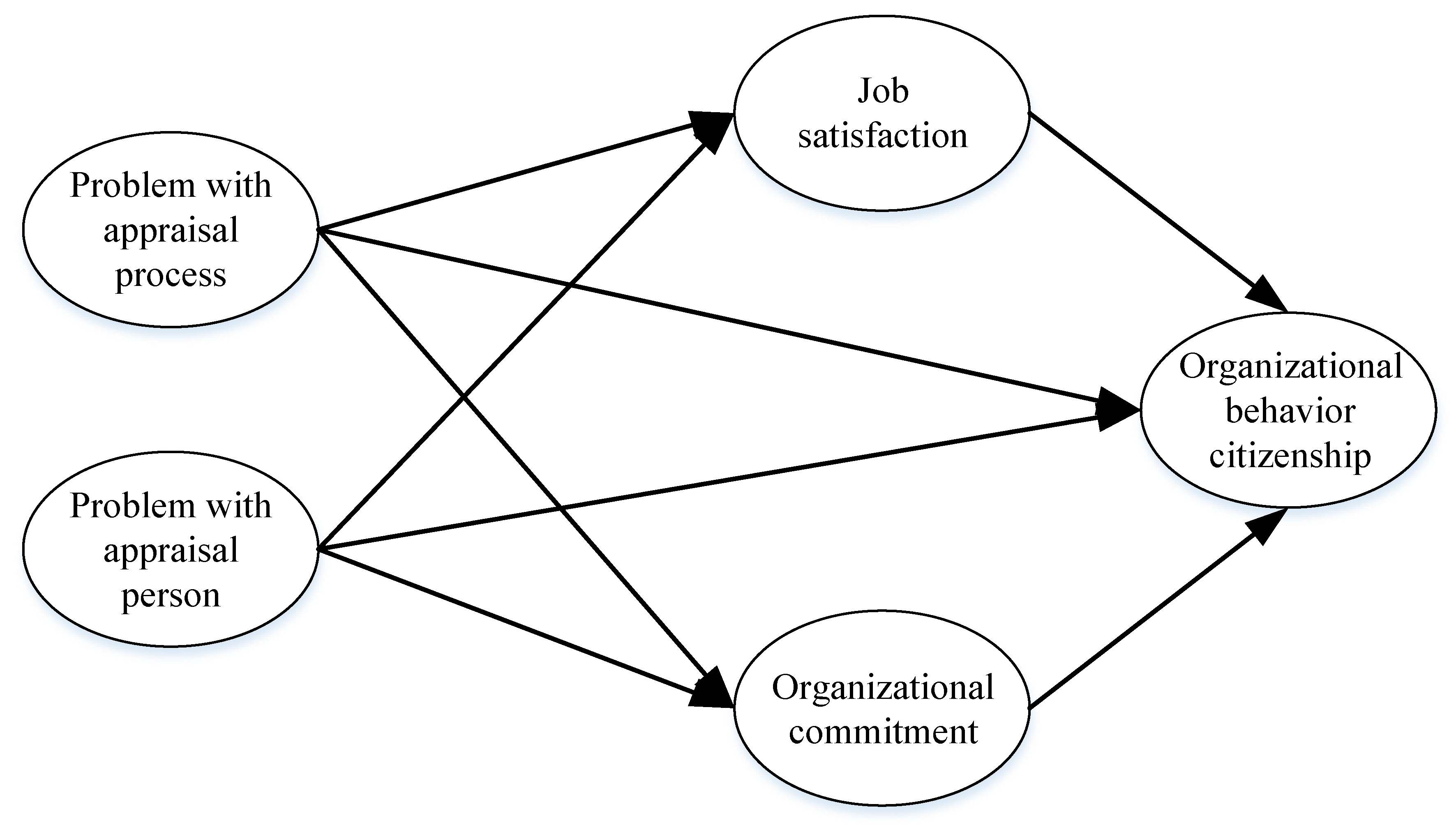

Joitmc Free Full Text Mediating Effects Of Job Satisfaction And Organizational Commitment Between Problems With Performance Appraisal And Organizational Citizenship Behavior Html

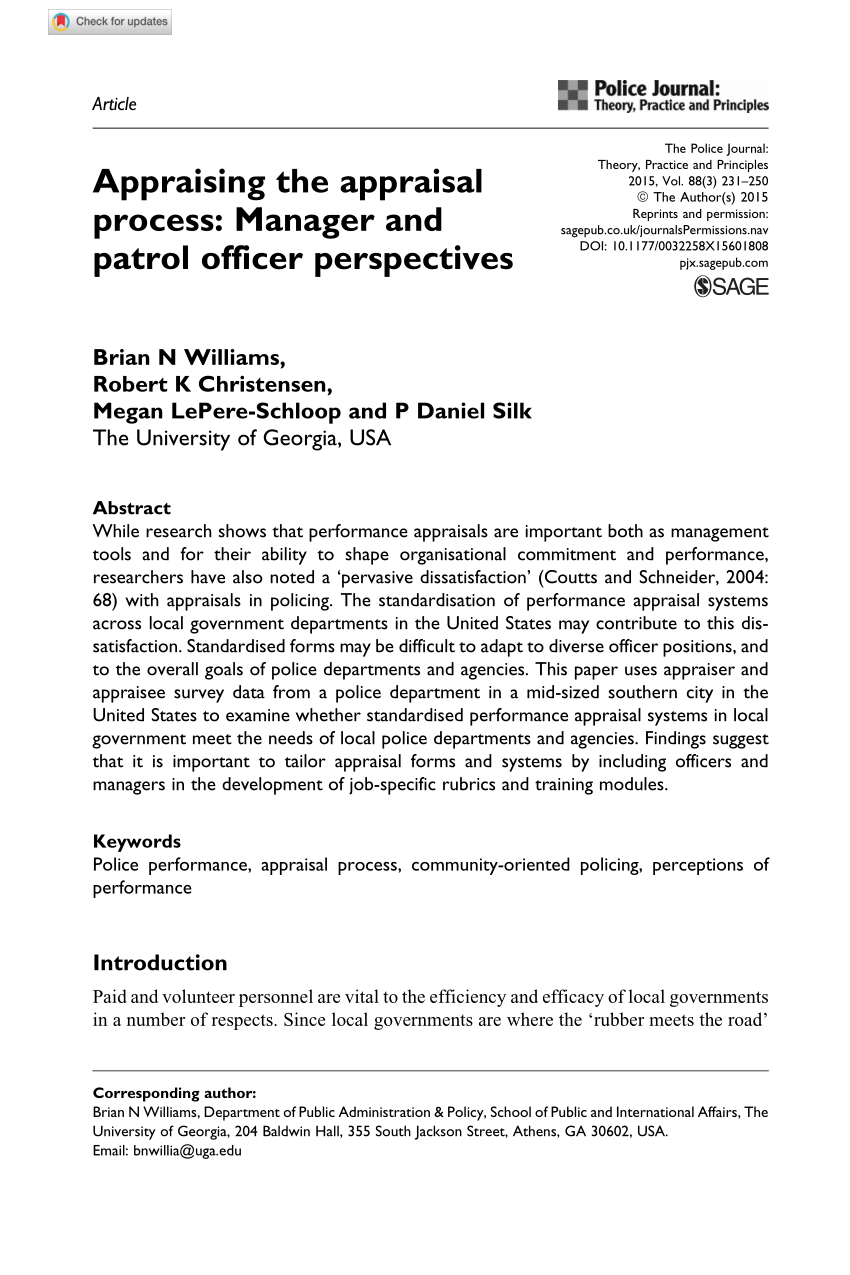

Pdf Appraising The Appraisal Process

Pdf Appraising The Appraisal Process

Uniform Standards Of Professional Appraisal Practice Uspap

Appraisal Reviews Vs Review Appraisals What S The Difference Commercial Residential Real Estate Appraisal Serving Massachusetts New England

Appraisal Resources Illinois Realtors

What Goes Into A Home Appraisal 25 Things Appraisers Will Note And Why They Care In 2022 Home Appraisal Appraisal Real Estate Tips

Joitmc Free Full Text Mediating Effects Of Job Satisfaction And Organizational Commitment Between Problems With Performance Appraisal And Organizational Citizenship Behavior Html

The Appraisal Foundation Announces Initiatives To Grow Diversity And Combat Bias In The Appraisal Profession